New stage of pharmaceutical investment : Bad news is out, innovation is the king

2025-05-12

Abstract:The golden window of pharmaceutical investment has arrived

Abstract:The golden window of pharmaceutical investment has arrived

In the first quarter of this year, at the business strategy conference of JD Capital, Zhang Yunfeng, managing director of the health investment department, shared his thoughts on pharmaceutical investment.

He mentioned that China's healthcare industry is a typical large sector, characterized by high certainty and significant growth potential. Currently, pharmaceutical investment is in a golden window period, with negative policies largely phased out and policy risks fully absorbed. Meanwhile, corporate valuation levels are significantly declining. Fundamentally, pharmaceutical investment is a process of long-term value discovery. In the face of cyclical industry fluctuations, we must maintain a keen insight into the policy environment while steadfastly adhering to professional judgment.

The following is a summary of Zhang Yunfeng's speech at the scene :

Ⅰ. The golden window for pharmaceutical investment has arrived

First, I'd like to share with you a few sets of data:

Big Industry: According to the latest data, China's total medical expenditure in 2023 has reached 9 trillion yuan (4 trillion US dollars). The CAGR in the past five years is about 9%, and it is predicted that the CAGR in the next five years will be more than 7%, and the total medical expenditure will reach 15 trillion yuan in 2030. This data reflects the rapid growth of China's medical industry.

Ⅰ. The golden window for pharmaceutical investment has arrived

First, I'd like to share with you a few sets of data:

Big Industry: According to the latest data, China's total medical expenditure in 2023 has reached 9 trillion yuan (4 trillion US dollars). The CAGR in the past five years is about 9%, and it is predicted that the CAGR in the next five years will be more than 7%, and the total medical expenditure will reach 15 trillion yuan in 2030. This data reflects the rapid growth of China's medical industry.

Ⅰ. The golden window for pharmaceutical investment has arrived

First, I'd like to share with you a few sets of data:

Big Industry: According to the latest data, China's total medical expenditure in 2023 has reached 9 trillion yuan (4 trillion US dollars). The CAGR in the past five years is about 9%, and it is predicted that the CAGR in the next five years will be more than 7%, and the total medical expenditure will reach 15 trillion yuan in 2030. This data reflects the rapid growth of China's medical industry.

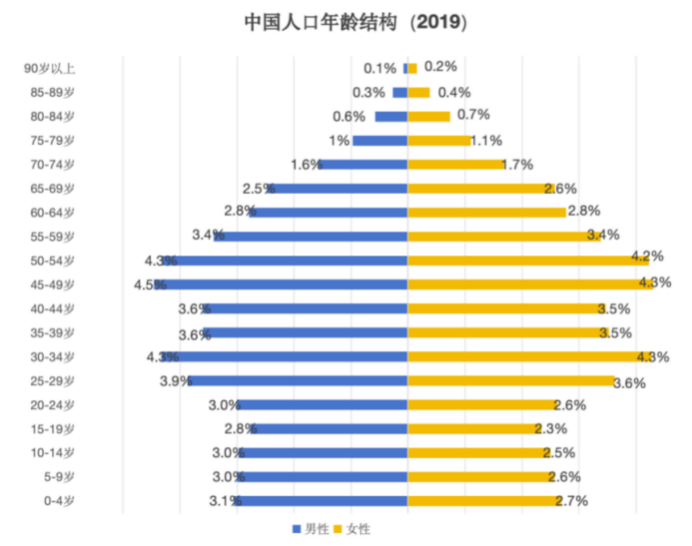

High Determination: The per capita medical expenditure in China is only 6,000 RMB, with figures for 2020-2023 being 5,112 RMB, 5,440 RMB, 6,044 RMB, and 6,425 RMB, respectively. In contrast, the per capita expenditure in the United States exceeds $10,000, while in China it is less than one-tenth of that. Additionally, according to the 2019 sample population census, the proportion of people aged 50 and over is 33.4%, and this group is expected to exceed half by 2030. If we consider newborns as our observation subjects, they will face unprecedented pension pressures when they enter society in 20 years. Therefore, in the long term, with the intensification of aging, China's health spending will continue to increase.

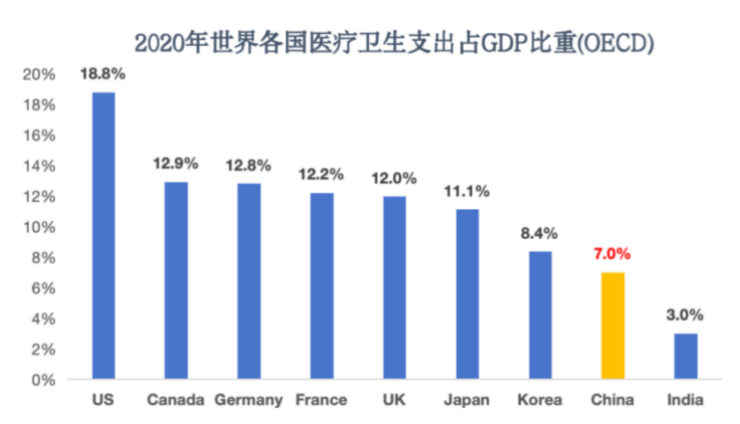

Great Potential: China's health spending as a share of GDP will increase from 5% in 2011 to 7% in 2023, which is still far from the level of developed countries.

Based on the data, let's take a look at the current situation of China's pharmaceutical investment.

I believe that in recent years, you have deeply felt the market downturn and been frequently affected by policy regulation. However, from an investment perspective, we are relatively fortunate: at the peak of industry valuation in 2021, we slowed down our investment pace. If we had invested in pharmaceutical projects at that time, we would most likely face losses now.

In the face of the current window period, we believe that the industry is showing two important characteristics: first, the negative policy has been basically released, and the policy risk has been fully digested; second, the valuation level is significantly reduced.

In terms of policy, in the short term, it is hard to imagine any new policies that could further impact the industry. The current policies are likely to be positive, such as the recent adjustments to centralized medicine procurement. During the implementation of centralized procurement, some medical institutions reported a decline in medicine efficacy. However, the National Healthcare Security Administration has clarified through official channels that the policy adjustment aims to regulate the market rather than reduce quality. This marks the industry's gradual return to a rational development path.

In terms of valuation, based on our recent industry research, the valuation levels of many pharmaceutical companies have generally seen a correction of over 50% from their peak periods. This revaluation has brought previously unaffordable targets back into our investment scope, ensuring both growth support and a valuation safety margin. Coupled with the stabilization of policy expectations, especially the recent policy signals released by the National Medical Products Administration, including accelerated review and approval of innovative drugs and reforms in medicine pricing mechanisms, these measures have injected momentum into the industry.

Especially taking innovative drugs as an example, the R&D of innovative drugs in our country continues to maintain a strong growth trend, with an annual compound growth rate consistently above 20%. According to regulatory data, key indicators such as the number of clinical trial applications for Class 1 new drugs accepted by drug regulatory authorities and the number of special approval channel projects for innovative medical devices have all shown a steady upward trend, further confirming the continuous release of industry innovation vitality.

It is worth noting that the latest drug price management guidance document particularly emphasizes that the dynamic price adjustment mechanism should be used to stimulate the innovation vitality of enterprises, and focus on supporting breakthrough therapies with clinical value, which not only creates a more favorable development environment for innovative drug enterprises, but also lays a system foundation for the long-term development of the industry.

At the same time, regulatory authorities have established several mechanisms to ensure the implementation of incentive policies, such as requiring commercial insurance institutions to set up medical investment funds to promote industry development, which was unimaginable in the past; and expanding health insurance coverage to include group protection, among others. Overall, the current attitude of the state towards the pharmaceutical industry has shifted from past restrictions and controls to protection and promotion. This fundamental shift in attitude has created a very favorable environment for us to engage in pharmaceutical investments.

To sum up, the current stage is indeed a golden opportunity to carry out medical investment. The combination of policy dividends and market adjustment opportunities enables us not only to screen high-quality projects, but also to take more initiative in valuation negotiations, which was completely impossible in the previous market environment.

Ⅱ. Industrial investment linkage: value upgrading from capital drive to industrial empowerment

In the face of market changes, we have first made a systematic adjustment in investment philosophy in recent years, and the company has also given great space for innovation and pilot support.

The most important change is that the model of relying solely on financial investment and waiting for enterprises to make profits and go public after capital investment has become unsustainable, and such projects have basically disappeared in the market. Therefore, we have carried out innovative exploration in the field of early investment and actively promoted industrial investment practice.

Specifically, in addition to capital investment, we are currently focusing on building a comprehensive platform business integration and empowerment system. In practice, we always emphasize seizing all resource integration opportunities, with each regional team actively expanding relevant channels. This means our investment strategy has a dual objective: to gain value-added returns from companies under reasonable valuations and clear growth potential; while simultaneously accelerating the development of invested companies through incremental business growth.

So far, our efforts have yielded initial results and strengthened the confidence of the team. Take a recent investment in a biomaterials company as an example. The project was never likely to be invested in in previous reviews: annual revenue was only over 10 million yuan, and financial data showed that its profit scale was clearly mismatched with the current valuation.

But now, our shift in investment decisions primarily stems from a renewal of our investment philosophy. At the same time, as we engage with companies, we assist them in connecting with end customers to obtain usage validation and integrate business resources to gather market feedback. These proactive empowerment actions generate positive signals that ultimately drive projects through reviews and complete investment transactions.

The investment process of this project is a concentrated reflection of our innovative exploration in the investment methodology. Essentially, relying on the team network and resource advantages of the company's layout in many places across the country, we are building an empowerment system that many institutions want to do but cannot achieve, which has become our core competitiveness.

In the future, we will continue to strengthen this business model that can not only help the invested enterprises develop, but also form a significant difference with other institutions in the market.

Ⅲ.Early stage investment exploration:return to first principles

As a frontier field integrating life science and artificial intelligence, the essence of the pharmaceutical industry is to serve human health. Therefore, the industry has long-term value resilience.

Today, against the backdrop of accelerated substitution of domestically innovated drugs and surging demand for precision medicine, leading enterprises with strong innovation capabilities can still enjoy the benefits of high valuations. Therefore, the true focus in investment should be on top-tier companies, especially those with long-term growth potential. As long as the industry direction is correct, such investments are viable.

In fact, whether it is early-stage or mature investment, the lack of confidence essentially stems from uncertainty about future trends. When investors cannot penetrate the fog of information to predict the ultimate fate of an industry, concerns naturally arise. This is the fundamental reason why investments need to be supported by faith. However, this faith must be based on rational judgment, not blind confidence.

Taking our recently invested project as an example, although the company's current revenue is only around 12 million, evaluating its value requires looking beyond short-term appearances: This project focuses on cancer treatment, and the company has developed a comprehensive methodology through innovative technological approaches, demonstrating strong technical advantages. As an early leader in the materials industry, its profit model has been validated by the market, ensuring basic survival capabilities. More importantly, as the industry develops, companies that occupy the technological high ground will gain maximum growth potential and may become leaders in industry transformation.

Based on the judgment of the industry's endgame, we use first principles to derive the investment logic: the underlying logic of technology is established, the industry has clear growth space, and the enterprise occupies a key ecological position —— These three elements together constitute the confidence basis for investment decisions.

Based on practice, we have summarized several important dimensions to judge early-stage projects in the pharmaceutical field:

First, focus on the market size of niche tracks and use this as the judgment logic. For example, when evaluating a new drug project, the primary logic for judging its investment value lies in analyzing the source of core demand, because demand directly corresponds to value. This is specifically manifested in the patient population base corresponding to the indication, per capita treatment costs, and total market size.

For example, the biggest demand of China's medical industry is currently concentrated in related fields such as hypertension, diabetes and cancer. The tracks involving these diseases usually have considerable market space. Accordingly, the overall success rate will be significantly improved by selecting leading enterprises for investment in these major demand areas.

Secondly, focus on the company's competitive advantages. In pharmaceutical investments, regardless of the size of the niche market, companies with leading positions should be chosen. For small-scale niche markets, invest in absolute leaders; for large-scale markets, at least select top-tier secondary leaders. Grasping this competitive landscape directly affects the company's core competitiveness and valuation level.

It is worth noting that the concept of "leader" we refer to is relative: in mature industries, it refers to the leader in scale, such as our strong belief that traditional large pharmaceutical companies will transform into true Big Pharma by transforming into innovative drugs; in emerging fields, it refers to the leader with the strongest core technology.

Third, the level of enterprise management determines survival or failure. This includes two aspects: First, the scientific nature of corporate governance mechanisms. If a company suffers from internal management chaos, weak financial control, and severe internal friction, even with technological advantages, it will struggle to achieve commercial success. Second, the vision and perspective of the founding team. Without a robust management system, even excellent technical assets can be hindered by inefficient operations. This is especially crucial for the pharmaceutical industry, which requires long-term planning and high investment. The strategic thinking ability of the founder and the design of team incentive mechanisms are particularly important.

Fourth, in terms of financial metrics, companies must have verifiable revenue foundations. Given the long R&D cycles and high approval risks in the pharmaceutical industry, projects that rely entirely on future expectations without existing revenue validation lack the certainty required to meet our investment criteria. Therefore, during the evaluation process, we will focus on verifying the company's current revenue scale and growth trajectory, which is a crucial empirical basis for assessing project feasibility. On this foundation, our assessment of future growth potential can also emphasize the company's second growth curve, incorporating possibilities such as business transformation into the discussion.

In summary, the fundamental logic supporting our focus on early-stage projects in pharmaceutical investment lies in the fact that any pharmaceutical project must withstand the test of "first principles." By employing a systematic evaluation framework that includes "verification of demand authenticity (market size) + assessment of competitive advantage (technological barriers) + examination of management efficiency (operational capabilities)," we can effectively enhance the accuracy of our early-stage project judgments in this field.

Ⅳ.Focus on the core track: combine industry and finance to lock in the best investment opportunities

In terms of investment strategy, in order to better optimize resource allocation and improve investment efficiency, we focus on building an investment model with higher success rate: shrinking the scope of the proposed sub-track coverage and focusing on the sub-track with more certainty and growth.

First of all, we should focus on the "water sellers" in the upstream of the industrial chain. Taking innovative drugs/instruments as an example, we believe that although there is policy support in this field, there is no risk of centralized procurement, and the overall prospect is good, but there are great uncertainties in the success rate and time, and individual enterprises need to bear great risks.

Therefore, we choose to allocate the majority of our funds to upstream industries that are more certain to benefit, such as CXO, matrix gel, culture media, proteins and cytokines, bioreactors, and purification fillers. At the same time, leveraging our industry empowerment capabilities (including business resource alignment and strategic synergy), we adopt a "focus + empower" model to more effectively gain valuation advantages, ultimately achieving excess investment returns.

Secondly, compared to the traditional chemical pharmaceutical sector, the gap between domestic enterprises and international leaders in China's bio-pharmaceutical industry is narrowing. By breaking through with foundational technologies such as gene editing, DNA synthesis, cell culture, and sequencing, sub-sectors like vaccines, monoclonal antibodies, and biosimilars have shown strong potential for overtaking on the curve. We believe that key upstream segments in industries such as gene therapy (CGT), synthetic biology, iPSCs, organoids, and molecular diagnostics will continue to maintain high prosperity cycles.

Take cell gene therapy (CGT) CDMO as an example. As a new generation of precision treatment methods, this field has become the most potential and investment value track. At the same time, CGT-CDMO, as a "water seller" providing third-party services, is characterized by high production process difficulty and high customer stickiness.

Data shows that as of November 2023,50 cell and gene therapies have been approved globally. Among these, the U.S. FDA has approved 17 gene therapy drugs, the European EMA has approved 15, and China's NMPA has approved 6. As of 2023, there are over 3,300 ongoing CGT clinical trials worldwide, with more than 300 in China. Overall, over 90% of global clinical trials are in Phase I and II, indicating that the CGT industry is still in its early stages of rapid growth.

China is currently on par with the United States in the field of cell therapy and is catching up rapidly in viral vectors and gene therapy. Moreover, due to case advantages and cost benefits, China has become the most active region globally in gene therapy research and development. Although there is still a valuation bubble in this sector, we have found during our tracking and research that industry valuations have started to decline. In the future, we will continue to monitor and seek opportunities to enter high-quality targets.

In addition, we also focus on high-end medical devices, raw material pharmaceutical formulation integration enterprises. This field will benefit from China's huge and rapidly expanding medical market and the increase of domestic production rate, among which a number of local pharmaceutical industry leading enterprises will grow and are expected to enter the international market.

In terms of investment mode, we adopt the way of "integration of industry and finance" to promote.

First, through industry research and expansion, establish connections with most companies in the proposed sector to coordinate and promote business cooperation among all parties; by deeply engaging in business collaborations within the industry, deepen our understanding and influence of the industry and enterprises. This ensures both the reliability of project sources and achieves a balance between investment returns and risk control. At the same time, assisting in connecting upstream and downstream enterprises can help solve issues such as sales channels and reduce procurement costs to some extent.

During this process, the information from both parties after verifying their respective products/technologies will be fed back to us. Ultimately, through long-term cooperation, not only can we deepen the industry's trust and recognition of us, but also have the opportunity to secure high-quality projects. More importantly, throughout this process, we can gain a deeper understanding of the founding team, technology, and business from multiple dimensions, rather than relying solely on a single due diligence.

In essence, pharmaceutical investment is a long-term process of value discovery. In the face of cyclical fluctuations in the industry, as investors, we should not only maintain a keen insight into the policy environment, but also adhere to the determination of professional judgment.